If want to build wealth, the type of assets you purchase will play a major role in your success. Appreciating assets help you build wealth, and depreciating assets can prevent or slow your ability to build wealth.

Today we will discuss the differences so you can make smart choices on your path to prosperity.

Appreciating Assets.

Appreciating assets are assets have the ability to increase in value overtime. And usually produce income in one form or another.

Appreciating assets include:

- Stocks

- Real Estate

- Precious Metals (i.e. Gold)

- Alternative Assets

These assets are most likely going to increase in value overtime, but there is a chance that they could also lose value.

Example

You buy 100 shares of Amazon at $125/share in 2010 for a total of $12,500. Fast forward to 2018 and those shares are now worth $1,700/share. You initial investment of $12,500 is now worth $171,000…

Depreciating Assets.

Depreciating assets are assets that lose value over time, but may be necessary due to their functionality. Robert Kiyosaki, author of the Rich Dad series, defines depreciating assets as liabilities.

Depreciating assets include:

- Cars

- Clothes

- Furniture

- Electronics

Most of these assets are necessary in life, but you should be responsible when purchasing these assets. Meaning you shouldn’t be buying a Mercedes instead of investing for retirement.

Example

You buy an iPhone X in 2017 for $1,000. In 2019 you sell your iPhone X for $300 to buy the new iPhone – and the cycle repeats.

Assets & Debt

Bigger assets like real estate and cars may require debt to purchase. So if you’re looking to build wealth, when should you use debt to purchase assets? And when should you avoid debt?

Robert Kiyosaki defines Good Debt as debt that is used to buy assets that put money in your pocket, such as rental property. He then defines Bad Debt as debt that is used to buy liabilities (depreciating assets) that take money out of your pocket, such as a car.

Good Debt

With that in mind you should ideally only use debt to purchase assets that yield a return. And specifically a return higher than the interest rate you are paying to borrow the money.

Example

If you can obtain a loan with an interest rate of 4.25%. And purchase a rental property that will yield between 8-12%. Then this is a good use of debt because you are earning a return of 8-12% on money that cost you only 4.25%.

Bad Debt

Since bad debt takes money out of your pocket, and never puts it back, you should only use it when it is absolutely necessary. Plus if you use debt to buy a depreciating asset, the asset might depreciate faster than you pay off the loan. This means that even if you sold the asset, you still might not have enough to pay off the loan.

Examples

You take out a 5 year loan of $25,000 to buy a new car. In year 3 you decide you no longer want the car and sell it to pay off the remaining $17,000 loan balance. Unfortunately, the car is now only worth $14,500. This means you must either keep the car or pay the remaining $2,500 on the loan despite no longer having the car.

Another common example is credit card debt. And unlike most real estate or car loans, credit cards carry a higher interest rate, which can easily range between 8-20%+

You decide to purchase an iPhone X for $1,000 using a credit card with a 12% interest rate. If you only make the minimum payments of $25/month, it will take you over 4 years to pay off the phone. And the interest on the phone will be $283.47. This brings the total cost of the phone to $1,283.47.

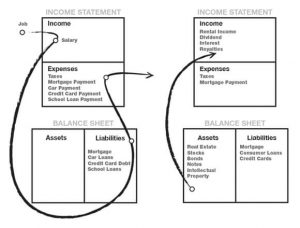

A diagram used by Robert Kiyosaki to show the impact of assets vs liabilities (and depreciating assets) have on your ability to build wealth.

How to Purchase Depreciating Assets

As you can see from the examples above, using debt to purchase depreciating assets can become costly.

Instead, its better to buy these assets in cash. Which may mean buying a used car or putting off the purchase of that new phone.

Also, its debatable weather or not leasing a car is better than buying. But I’d rather lease a car than buy a brand new car with a loan and deal with on going maintenance costs.

The Bottom Line.

If your goal is to build wealth then you should purchase appreciating assets, and avoid spending your money on depreciating assets whenever possible.

When it comes to debt, you should only use it to purchase assets that provide a higher return on your money than the interest rate on the loan it takes to purchase the asset.

Because at the end of the day, you want to save as much money as possible to acquire appreciating assets. And this requires that you to choose your depreciating assets and how you purchase them wisely.